Sneaky and Underhanded

I received a replacement for my old, worn-out, Chase debit card in the mail today. They issue them for three year periods and the old one had been swiped so many times that it was fraying on the edges and the numbers were nearly unreadable.

Anyhow, the first thing that annoyed me was when I called the number to activate the card. Their system took a total of three minutes to “activate” the card, of which 2.5 minutes was devoted to trying to sell me their identity theft protection (and you were not allowed to ignore the offer, as you had to select ‘2’ on the phone to get past it).

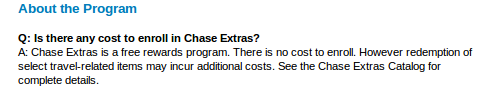

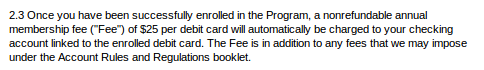

But I discovered the really sneaky and underhanded thing when I started looking into their “Free Debit Rewards Program.” The new debit card included an insert for the rewards program that said I could get points for using the card and that enrolling was “EASY—AND FREE!” This triggered my TANSTAAFL sensors, as there has to be some kind of catch (i.e. someone is paying for these “free rewards”). The main trick appears to be that you have to use the debit card as a credit card (i.e. don’t use a PIN), which I think triggers fees for the merchant. But the other trick is that there is a $25.00 annual fee. Which is pretty underhanded, because all of their brochures and *all* of their FAQ answers stress that it is free to enroll. It’s only in the Terms And Conditions that you learn about the “annual fee.” After parsing that for a minute I realized that they were legally correct, but morally bankrupt. ![]() It’s free to enroll. It just costs money to stay in the program.

It’s free to enroll. It just costs money to stay in the program.

What the FAQ promises…

… is taken away by the T’s and C’s:

That said, the program may still be worth it, especially since I use the card so often. But the way they hid the fee bothers me enough that I am going to pass on the program. In the interest of full disclosure they should have had at least one FAQ answer that covers the fact that there is an annual fee (and I skimmed *every* FAQ just to be sure; I could find no mention of it there, only in the T’s and C’s).

September 1, 2009

|

Posted by Aubrey Turner

September 1, 2009

|

Posted by Aubrey Turner

Categories:

Categories:

I am pretty close to dumping chase. I’ve been a chase customer for over 10 years. However, they recently started charging me $12 a month on one of my accounts. The lady told me that was because I had an average daily balance of less than $1200. I said, this is one of six linked accounts that I have. My savings has enough to cover all of these accounts $1200. Nope. Not good enough. Each account must have $1200 to avoid the fee. That sucks because that means I’ll have $6000 not earning interest. I’m sure that is there intent. Ugh.

I never really chose to be a Chase customer. I started with Bank One in 1993 and stayed with Chase after they bought Bank One more out of inertia than anything else.

Frankly, moving all of my direct deposits and automatic bill pays would be a major PITA, so they’d have to do something pretty egregious to get me to leave. Unfortunately, I think banks know this, which means they also know there’s a certain annoyance factor that has to be met before you’ll dump them.